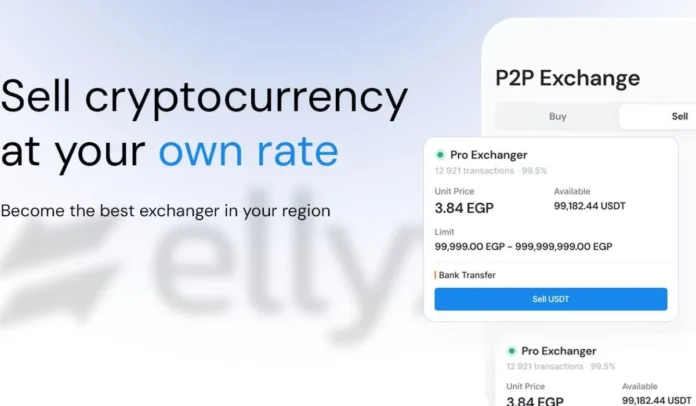

Cryptocurrency continues to reshape the global financial landscape, and with it, P2P trading platform solutions are becoming increasingly relevant. Users are drawn to this trading format because of its independence from intermediaries, significantly lower commission structures, and the ability to retain full control over their finances. However, these benefits go hand in hand with certain vulnerabilities, including fraud, phishing attempts, and technical lapses. Selecting a trusted P2P trading platform is vital to ensure your funds and personal data remain protected throughout the transaction process.

What are P2P Platforms So Popular Among Traders?

- Privacy and decentralization: Unlike traditional exchanges that control user data and limit control, a P2P platform allows individuals to connect and negotiate directly, offering greater anonymity.

- Lower fees: Traditional exchanges apply variable, percentage-based charges. In contrast, most P2P models apply minimal or fixed transaction costs, enabling better profit margins.

- Global access: Whether traditional banking access is limited or unavailable, peer-to-peer trading creates new pathways to digital finance regardless of region or infrastructure.

- Flexible payment options: A P2P trading platform can support diverse payment types, including regional methods and even direct cash options in supported jurisdictions.

Platforms focused on innovation and safety, such as Ellyx, continue to refine the P2P ecosystem by prioritizing security features and acquiring licenses that improve accessibility and compliance.

Common Threats Faced by P2P Traders

Even though this model offers great potential, it is not free from certain risks:

- Fake payment confirmations: Scammers may deceive sellers by sending fraudulent screenshots or requesting chargebacks after receiving assets.

- Phishing and impersonation: Cybercriminals often send users fake login pages or harmful links disguised as messages from legitimate P2P trading platform operators.

- Irreversible transfers: Once a crypto transaction is confirmed and sent to a malicious counterparty, there is no way to reverse the mistake.

- Low security on unreliable platforms: Traders using lesser-known platforms with no user reviews or regulatory oversight face a much higher chance of being scammed.

Reducing the Risk: Best Practices for Safer P2P Trading

- Use verified platforms. A reliable P2P trading platform should offer transparency and escrow features and have a visible track record. User reviews and visible support channels are a must.

- Secure your credentials. Activate two-factor authentication, use strong passwords, and avoid reusing login data across different websites.

- Avoid off-platform deals. If someone insists on finalizing the transaction outside of the official interface, it’s a clear red flag. All communications and payments should remain within the platform’s protected environment.

- Double-check the transaction terms. Make sure you understand the platform’s policies on fees, dispute resolution, and deadlines. Escrow mechanisms provide an added layer of safety and should be non-negotiable.

What’s Next for the P2P Trading Space?

As interest continues to grow, we can anticipate several key developments in the field of P2P transactions:

- Increased decentralization: With a rising demand for autonomy and privacy, more users are expected to migrate toward peer-to-peer systems.

- Tighter regulation: As legal frameworks evolve, platforms that already invest in compliance and transparency will be better positioned to meet new standards.

- Growth in smart contract use: Smart contracts will streamline the exchange process, adding automation, speed, and higher levels of transactional trust.

The future of peer-to-peer trading is driven by user expectations for freedom, simplicity, and security. A forward-thinking P2P trading platform meets these expectations by combining innovative tools with robust protection against threats. While one reliable name like Ellyx continues to set industry benchmarks, the broader P2P space is evolving rapidly, promising users more transparency, freedom, and financial control than ever before.